A drug formulary is a list of prescription medications that your health insurance plan agrees to cover. It’s not just a catalog-it’s a tool that decides which drugs you can get at a low cost, which ones will cost you more, and which ones might not be covered at all. If you’ve ever been surprised by a high pharmacy bill, or told your doctor you can’t fill a prescription because it’s "not on the list," you’ve run into a formulary. Understanding how it works can save you hundreds-or even thousands-of dollars a year.

How a Drug Formulary Works

Think of a drug formulary like a menu at a restaurant. Not every dish is available, and the ones that are come with different prices. Insurance companies and Pharmacy Benefit Managers (PBMs) build these lists to balance two things: what works medically, and what they can afford to pay for. They don’t just pick drugs randomly. A team of doctors, pharmacists, and researchers called a Pharmacy and Therapeutics (P&T) committee reviews every medication based on clinical studies, safety records, and cost-effectiveness. Only drugs that meet strict standards make the cut.Most formularies are divided into tiers. Each tier has a different cost for you, the patient. The higher the tier, the more you pay. This structure pushes patients toward cheaper, equally effective options without forcing them to sacrifice care.

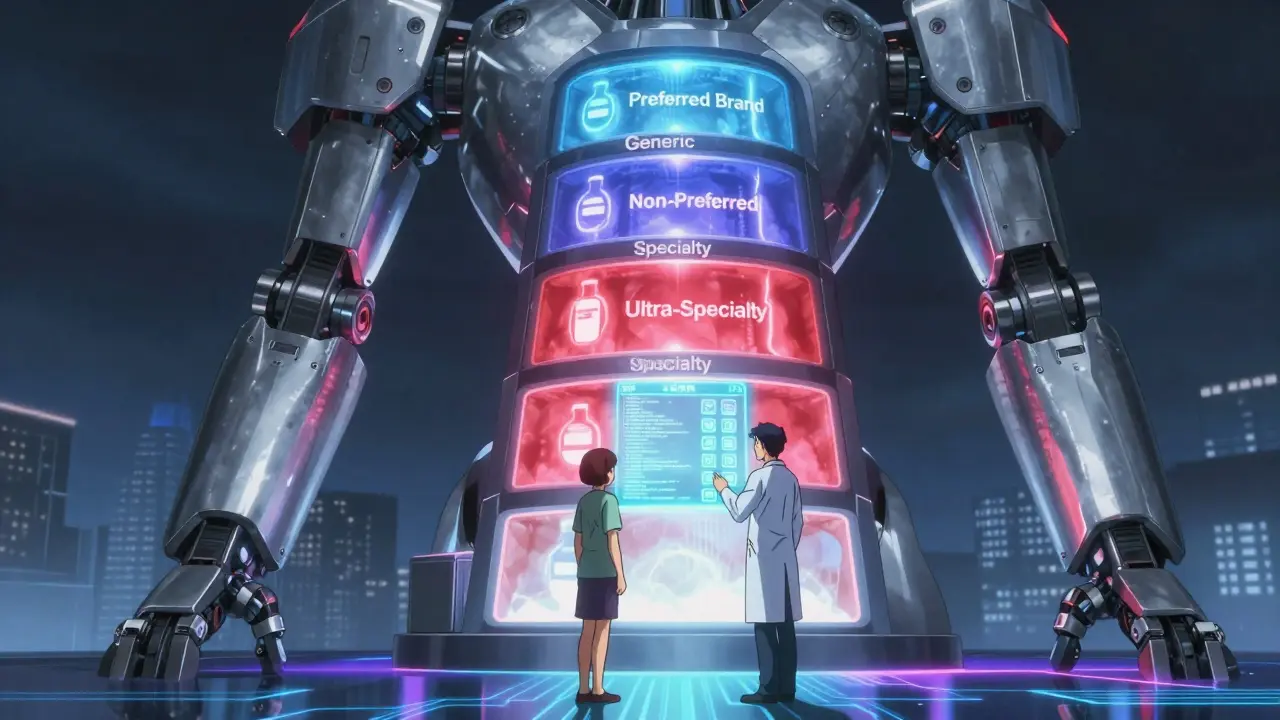

The Five Tiers Explained

Most plans use three to five tiers. Here’s what each one usually means:- Tier 1: Generic Drugs - These are the cheapest. They contain the same active ingredients as brand-name drugs but cost far less. For example, generic lisinopril for high blood pressure might cost you $5 or even $0 with insurance. The FDA requires generics to be identical in safety, strength, and performance to their brand-name versions.

- Tier 2: Preferred Brand-Name Drugs - These are brand-name medications that the plan has negotiated a good price for. You’ll pay more than for generics-usually $25 to $50 per prescription-but still less than non-preferred brands.

- Tier 3: Non-Preferred Brand-Name Drugs - These are brand-name drugs that aren’t on the plan’s preferred list. They might be newer, more expensive, or have cheaper alternatives available. Your cost here is typically $50 to $100 per prescription.

- Tier 4: Specialty Drugs - These are high-cost medications for complex conditions like cancer, rheumatoid arthritis, or multiple sclerosis. You might pay 30% to 50% coinsurance, or a $100+ copay. Some plans split this into Tier 4 and Tier 5 for the most expensive treatments.

- Tier 5: Ultra-Specialty Drugs - Reserved for the most expensive therapies, like gene therapies or certain biologics. Costs can reach $1,000 or more per month, even with insurance.

These tiers aren’t the same across all plans. A drug that’s Tier 2 on your Medicare plan might be Tier 3 on your employer’s plan. That’s why comparing formularies during open enrollment matters.

Why Some Drugs Aren’t Covered

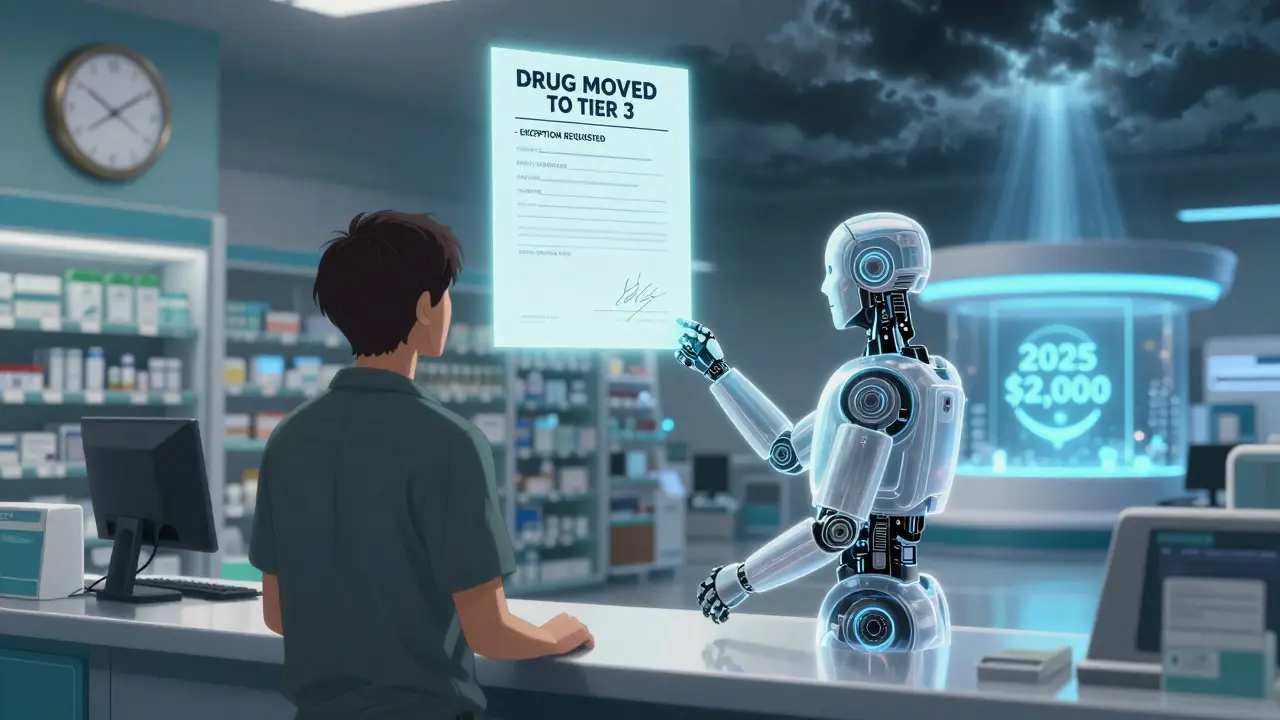

Not every medication makes it onto a formulary. Sometimes it’s because there’s a cheaper, equally effective generic. Other times, the drug is new and hasn’t been reviewed yet, or it hasn’t proven better than existing options. But if your doctor prescribes a drug that’s not on the list, you’re not stuck.You can request a formulary exception. This means asking your plan to cover a drug that’s not on their list. Your doctor must submit a letter explaining why you need it-maybe you tried all the alternatives and had side effects, or the non-formulary drug is the only one that works for your condition. Most plans approve these requests within 72 hours. In urgent cases, like if you’re in the hospital, they must respond within 24 hours. In 2023, about 67% of Medicare Part D exception requests were approved.

Other Restrictions You Might Face

Even if a drug is on the formulary, your plan might still put limits on it:- Prior Authorization - Your doctor has to get approval before the plan pays. This often happens with expensive or high-risk drugs.

- Step Therapy - You must try a cheaper drug first. For example, if you have asthma, your plan might require you to try an inhaler like albuterol before approving a more expensive one.

- Quantity Limits - You can only get a certain amount at a time. For instance, your plan might limit you to 30 pills per month, even if your doctor prescribes 60.

These rules aren’t meant to deny care-they’re meant to prevent waste and ensure safer use. But they can be frustrating. If you’re denied, you can appeal the decision.

Formularies Change-All the Time

Your formulary isn’t set in stone. Plans update them regularly, sometimes mid-year. A drug you’ve been taking for years could move from Tier 2 to Tier 3, or be removed entirely. That’s why you need to check your formulary every year during open enrollment (October 15 to December 7 for Medicare). But don’t wait-check it again when you refill a prescription. About 28% of formulary changes happen outside of open enrollment, according to the Patient Advocate Foundation.Medicare Part D plans must send you a notice if a drug you take is changing tiers or being removed. Commercial plans must give you 60 days’ notice. If you get a letter like this, call your pharmacist or plan directly. Ask: "Is there a similar drug on the formulary? Can I get an exception?" Don’t assume you’re stuck with a higher bill.

How to Find Your Plan’s Formulary

Every insurance plan publishes its full formulary online. Here’s how to find yours:- Log in to your insurer’s website and look for "Drug List," "Formulary," or "Prescription Benefits."

- For Medicare Part D, use the Medicare Plan Finder tool. Type in your medications, zip code, and pharmacy. It shows exactly what each plan covers and how much you’ll pay.

- Call customer service. Ask for a copy of the current formulary. They’re required to send it to you.

Always verify your medication’s tier before filling a prescription. A simple check can prevent a surprise bill.

Real Patient Stories

One patient on Reddit shared that her diabetes medication moved from Tier 2 to Tier 3. Her monthly cost jumped from $35 to $85. She switched to a generic version and saved $600 a year. Another, a cancer survivor, said her immunotherapy drug was on Tier 4. Instead of paying $5,000 out of pocket, she paid $95. "It saved my life financially," she wrote. But not everyone wins. A 2023 survey found that 31% of insured adults had a prescription denied because it wasn’t on the formulary. Many felt confused, frustrated, or even abandoned.What You Can Do

You have power here. You don’t have to accept a formulary’s limits without fighting back:- Ask your doctor: "Is there a generic or preferred brand on the formulary?"

- Use GoodRx or SingleCare to compare cash prices-even if a drug isn’t covered, the cash price might be lower than your copay.

- Request a formulary exception if your medication is essential and not covered.

- During open enrollment, compare plans based on your medications-not just premiums.

- Keep a list of your prescriptions and their tiers. Update it every time you get a new prescription.

Formularies exist to make healthcare more affordable. But they only work if you understand them. The system isn’t perfect. Some patients fall through the cracks. But with the right knowledge, you can navigate it successfully-and protect your wallet while getting the care you need.

What’s Changing in 2025

Starting January 1, 2025, Medicare Part D will cap out-of-pocket costs for all covered drugs at $2,000 per year. That’s a huge shift. Previously, people with expensive medications could pay tens of thousands. Now, there’s a hard stop.Also, insulin will still be capped at $35 per month. More biosimilars (lower-cost versions of biologic drugs) are hitting the market, and formularies are starting to favor them. Expect more drugs to move to lower tiers as competition increases.

By 2027, AI tools will help plans predict which drugs work best for individual patients, making formularies more personalized and less one-size-fits-all.

What happens if my drug is not on the formulary?

If your drug isn’t on the formulary, you’ll likely pay full price unless you get an exception. Talk to your doctor about switching to a similar drug on the list. If that’s not possible, your doctor can submit a request for a formulary exception. The plan must respond within 72 hours, or 24 hours if it’s urgent. About two-thirds of these requests are approved.

Can a drug be removed from the formulary during the year?

Yes. Plans can remove or change the tier of a drug during the year, but they must give you 60 days’ notice. If you’re on a long-term medication, check your formulary every time you refill your prescription. Don’t wait for a letter-stay proactive.

Do all insurance plans have the same formulary?

No. Every plan creates its own formulary. A drug that’s Tier 2 on one plan might be Tier 4 on another. Medicare Part D plans must cover at least two drugs per category, but beyond that, they can vary widely. That’s why comparing formularies during open enrollment is critical.

Are generics as good as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage, and effectiveness as brand-name drugs. The only differences are in inactive ingredients like fillers or coatings, which don’t affect how the drug works. Generics are tested for bioequivalence and are safe and reliable.

Why do some drugs require prior authorization?

Prior authorization helps prevent overuse or misuse of expensive or high-risk drugs. It ensures that cheaper, equally effective options were tried first, or that the drug is being used for an approved condition. It’s not a denial-it’s a safety check. Your doctor provides the medical reason, and the plan reviews it.

How often should I check my formulary?

Check it at least once a year during open enrollment. But also check every time you get a new prescription or refill. Formularies change frequently-sometimes without warning. A drug that was covered last month might not be covered this month.

What’s the difference between a formulary and a drug list?

There’s no difference. "Drug list," "preferred drug list," and "formulary" all mean the same thing. These terms are used interchangeably by insurers, PBMs, and pharmacies.

11 Comments

Aaron Mercado

So let me get this straight-insurance companies get to play god with my meds?!! I’ve been on the same drug for 8 years, and last year they moved it to Tier 5… and now I’m paying $1,200 a month?? And they wonder why people skip doses?? This isn’t healthcare-it’s a rigged casino!!!

saurabh singh

Hey guys, from India here-our system is different but the pain is same! Even with government schemes, some life-saving drugs are still out of reach. But hey, knowledge is power! Read your formulary, ask your pharmacist, and never accept ‘no’ without asking ‘why?’ You got this! 💪

Dee Humprey

I used to think generics were ‘cheap knockoffs’ until my doctor switched me to generic metformin. Same results, $3 a month. I wish I’d known this 10 years ago. Check your formulary. It’s not boring-it’s life-changing. 🩺

John Wilmerding

It is imperative to underscore that the structure of pharmaceutical formularies is predicated upon evidence-based clinical evaluation and fiscal responsibility. The tiered system is not arbitrary; it is the result of rigorous deliberation by Pharmacy and Therapeutics Committees, which are composed of credentialed medical professionals. Patients are encouraged to consult their formulary documents with diligence, as this constitutes a fundamental component of informed healthcare decision-making.

Peyton Feuer

My mom got hit with a tier change last year and didn’t even know until she got billed. I helped her file an exception-got it approved in 48 hours. Just call your plan. Seriously. They have to answer you. Don’t let fear stop you from asking.

Siobhan Goggin

It’s wild how something so technical can make or break someone’s health. I’m glad this guide exists. People need to know they’re not powerless here.

Vikram Sujay

The formulary, as a mechanism of resource allocation, reflects not merely economic constraints but also the epistemological priorities of institutional medicine. One might ask: who determines ‘equivalent efficacy’? Is it the P&T committee’s consensus, or the market’s influence? The patient, in this architecture, is often the silent variable. Yet, the possibility of exception remains a moral counterweight to systemic indifference.

Jay Tejada

So the system’s rigged, but you’re supposed to ‘fight back’? Cool. I’ll just go ahead and die quietly then. 😅

Shanna Sung

They’re doing this on purpose. The big pharma lobbyists wrote the rules. The formulary isn’t about saving money-it’s about controlling you. They want you dependent on their overpriced stuff. That’s why they push generics so hard-so you think you’re getting a deal when you’re just being manipulated. And don’t get me started on AI in 2027… they’re gonna track your DNA next

Allen Ye

Let us not forget that the formulary is not an isolated phenomenon but rather a symptom of a broader structural crisis in American healthcare, wherein commodification has supplanted care, and profit metrics have eclipsed therapeutic outcomes. The tiered system, while ostensibly rational, functions as a form of economic triage-prioritizing cost over compassion, and convenience over clinical nuance. The patient, in this paradigm, becomes a ledger entry, a line item in a balance sheet, rather than a human being with unique physiological, psychological, and socioeconomic needs. The fact that we have to navigate this labyrinth with GoodRx and exception requests reveals not a system working as intended, but one that has been deliberately engineered to obscure access behind bureaucratic fog. Until we treat medication as a human right rather than a market commodity, we will continue to see families choosing between insulin and rent, between life and ledger.

mark etang

Effective utilization of formulary information represents a critical component of patient empowerment. It is strongly recommended that all beneficiaries conduct a comprehensive review of their prescription coverage annually during the open enrollment period. Furthermore, proactive communication with both prescribing clinicians and pharmacy benefit managers is essential to ensure continuity of care and financial predictability. The adoption of these best practices significantly mitigates the risk of therapeutic disruption and unexpected out-of-pocket expenditures.