When you’re on multiple medications, your insurance plan might push you toward a generic combination drug-a single pill that blends two or more active ingredients. But sometimes, your plan covers the individual generics separately and not the combo. And that can mean paying more-sometimes a lot more. It’s not a mistake. It’s a calculation. And if you don’t understand how it works, you could be leaving money on the table-or worse, skipping doses because the cost is too high.

Why Insurance Plans Push Generic Combinations

Most insurance plans, including Medicare Part D and private plans, are built to save money. And they do that by favoring generics. In 2019, 84% of all drug choices in Medicare Part D plans were generic-only. That means if a brand-name version existed, it wasn’t covered unless you had a very specific reason. Why? Because generics cost 80-85% less than brand-name drugs. Some with six or more generic makers dropped as much as 95% in price. Generic combination drugs take this a step further. Instead of taking two pills a day, you take one. That’s easier. And for insurers, it’s cheaper to manage. Fewer pills mean fewer claims, fewer refill requests, and better adherence. Studies show people are more likely to stick with a single pill than two or three. So plans reward that behavior-usually by putting the combo drug in the lowest tier, where your copay might be $0 to $5.When the Combo Costs More Than the Two Separate Pills

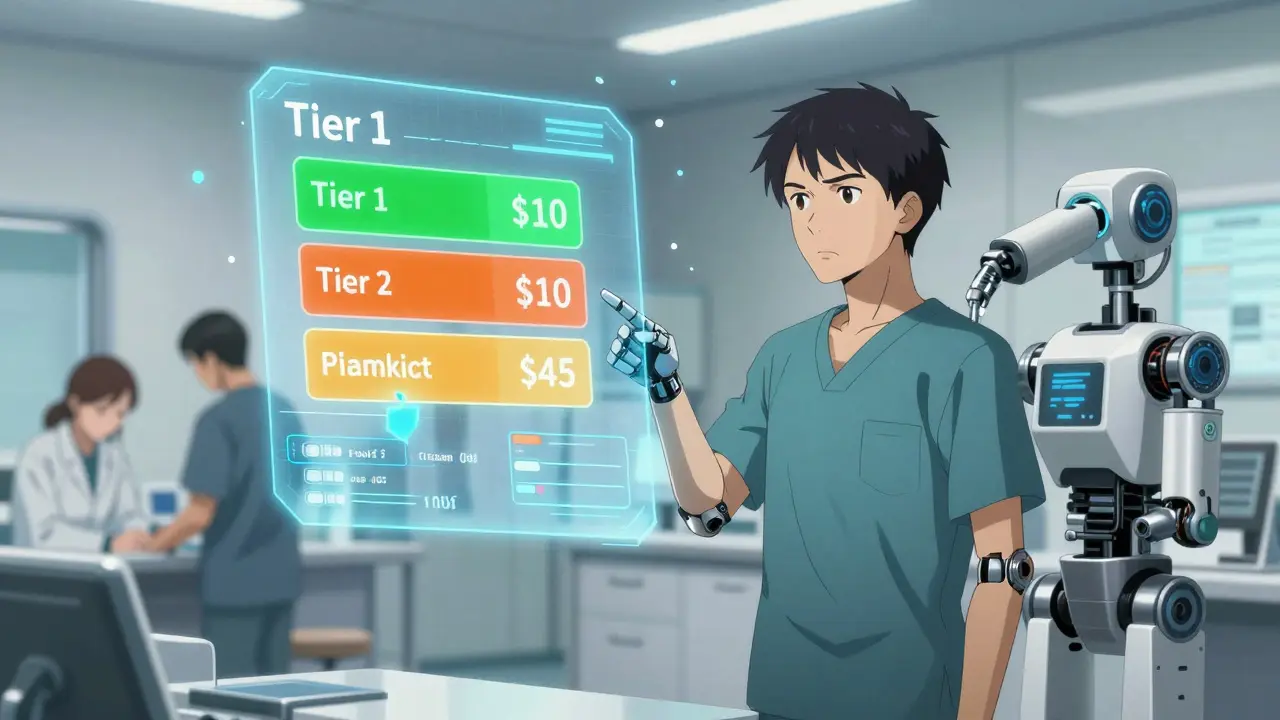

Here’s where things get confusing. Sometimes, your plan covers the two individual generic pills for $10 each-so $20 total. But the combination version? $45. That’s not a typo. That’s how some formularies are built. Why? Because the combo drug might be a single-source generic. That means only one company makes it. No competition. No price pressure. Even though it’s technically generic, it’s priced like a brand-name drug. Meanwhile, the two individual generics are made by five or six different manufacturers, so their prices are driven down by competition. Real example: A patient in Ohio was prescribed a combo pill for high blood pressure-amlodipine and lisinopril. The combo was $52 per month. But the two separate generics? $8 each. So she asked her doctor to write two prescriptions. She saved $36 a month. That’s $432 a year. And it’s legal. It’s common. And most insurers won’t stop you.Tiers, Copays, and How Your Plan Decides What You Pay

Insurance plans organize drugs into tiers. Think of them like levels in a video game-the lower the tier, the cheaper your copay.- Tier 1: Preferred generics. Often $0-$5 copay. This is where most combo generics land-if they’re priced right.

- Tier 2: Non-preferred generics or preferred brand-name drugs. Usually $10-$20.

- Tier 3: Non-preferred brand-name drugs. $40-$80.

- Tier 4 (Specialty): High-cost drugs like biologics or cancer meds. $100+.

What You Can Do: How to Save Money on Generic Combinations

You don’t have to accept what your plan says. Here’s how to fight back:- Check your plan’s formulary. Go to your insurer’s website. Search for your drug by name. Look at the tier and copay for both the combo and the individual components.

- Ask your pharmacist. They see this every day. Ask: “Is it cheaper to get two separate generics instead of the combo?”

- Ask your doctor to write separate prescriptions. Many doctors assume the combo is better. But if the math favors separate pills, your doctor can write two prescriptions. It’s legal. It’s safe. And insurers can’t block it.

- Use the Medicare Plan Finder. If you’re on Medicare, use the official tool. It shows you exactly what each plan charges for each drug. You can compare plans side by side.

- File a coverage appeal. If your plan denies the combo but you need it, your doctor can submit a “coverage determination” request. It takes 72 hours for a standard review, 24 hours if you’re sick.

The Bigger Picture: Why This Matters Beyond Your Wallet

This isn’t just about saving $30 a month. It’s about whether you take your meds at all. A 2023 study found that patients who paid more than $50 a month for their blood pressure meds were 40% more likely to skip doses. That’s dangerous. High blood pressure doesn’t care if your insurance thinks a combo pill is “too expensive.” It just keeps rising. The Inflation Reduction Act, which took effect in January 2024, capped out-of-pocket drug costs at $2,000 a year for Medicare beneficiaries. That’s huge. But it doesn’t fix the underlying problem: formularies are still confusing, opaque, and sometimes illogical. And here’s the kicker: 68% of Medicare beneficiaries say they need help understanding their drug coverage. If you’re one of them, you’re not alone.

What’s Changing in 2025 and Beyond

More combo drugs are going generic. The FDA’s Generic Drug User Fee Amendments (GDUFA) III are speeding up approvals. By 2028, the number of generic combination drugs is expected to grow by over 40%. That means more options. More competition. Lower prices. Also, a major court ruling in September 2023 banned “copay accumulator” programs. These programs used to stop manufacturer coupons from counting toward your deductible. That meant people on expensive brand-name drugs paid more. Now, those coupons can count. That’s good news for anyone on combo drugs that still have brand-name versions. But here’s what won’t change: insurers will always look for the cheapest way to cover your meds. Your job? Know the system. Ask the right questions. And don’t be afraid to push back.Common Mistakes People Make

- Assuming the combo pill is always cheaper. (It’s not.)

- Not checking your plan’s formulary before filling a new prescription.

- Letting your doctor write the combo script without asking if separate pills are cheaper.

- Not using the Medicare Plan Finder or your insurer’s drug lookup tool.

- Thinking if it’s “generic,” it must be cheap. (Single-source generics can be expensive.)

Final Thought: You’re the Key to Your Own Care

Insurance companies don’t make decisions based on what’s best for you. They make decisions based on what’s cheapest for them. That’s not evil. It’s business. But you’re not powerless. You have the right to ask. To compare. To appeal. To choose. And if you do, you could save hundreds-maybe over a thousand-dollars a year. That’s not just money. That’s peace of mind. That’s being able to take your meds without stress. Start today. Open your plan’s website. Look up your drugs. Compare the combo to the individual pills. Call your pharmacist. Ask your doctor. You’ve got nothing to lose-and a lot to gain.Is a generic combination drug always cheaper than two separate generic pills?

No. Sometimes the combination drug is a single-source generic with no competition, making it more expensive than two widely available individual generics. Always compare the copay for the combo versus the separate pills using your plan’s formulary or by asking your pharmacist.

Can I ask my doctor to prescribe individual generics instead of a combo?

Yes. You can ask your doctor to write two separate prescriptions instead of one combo pill. This is legal, medically safe, and often saves money. Many patients do this to avoid high copays on single-source generic combinations.

Why does Medicare cover generics but not always the combo version?

Medicare Part D plans cover generics because they’re cheaper, but they don’t automatically cover every generic combo. Coverage depends on the plan’s formulary, which is built by pharmacy benefit managers (PBMs). Some combos are placed in higher tiers if they’re priced above individual generics, even if they’re technically generic.

What’s a single-source generic, and why does it matter?

A single-source generic is a generic drug made by only one manufacturer. Without competition, the price doesn’t drop like it does with multiple makers. These can cost nearly as much as brand-name drugs, making them a bad deal even though they’re labeled “generic.” Always check if your combo drug is single-source.

How do I find out what my insurance plan covers?

Go to your insurer’s website and use their drug formulary lookup tool. For Medicare, use the official Medicare Plan Finder. Search for your drug by name and compare the copay for the combo versus the individual components. If the info is unclear, call your plan’s customer service.

Can I appeal if my plan won’t cover the combo drug I need?

Yes. Your doctor can submit a “coverage determination” request. For standard requests, it takes 72 hours. If you’re seriously ill, you can request an expedited review, which takes 24 hours. Include medical reasons why the combo is necessary-like difficulty swallowing pills or adherence issues with multiple medications.

Next steps: Check your current prescription. Look up the copay for the combo and the individual pills. If there’s a difference of $15 or more, talk to your doctor. You might be able to save hundreds this year-just by asking.

12 Comments

Ryan Riesterer

Generic combination drugs are often structured as single-source generics to circumvent competitive pricing dynamics. The formulary tiering logic is fundamentally driven by PBM rebate structures, not clinical efficacy. The $45 combo versus $16 in separate generics? Classic case of non-competitive market capture. The FDA’s GDUFA III will mitigate this, but until then, it’s a regulatory arbitrage opportunity for PBMs.

Akriti Jain

So insurance companies are literally profit-pushing you to take more pills so they can charge you more?? 😂💸 Meanwhile, your blood pressure is climbing and your bank account is crying. Next they’ll charge you for breathing too hard. #PharmaIsAScam 🤡💊

Liberty C

How quaint that you think this is about cost. This is about control. The system doesn’t want you to be empowered-it wants you compliant. A single-pill regimen is easier to track, easier to manipulate, easier to monetize. You think you’re saving money? You’re just being conditioned to accept the illusion of choice. Real autonomy requires reading the formulary like a legal contract. And most people? They don’t even know what a PBM is. That’s the point.

Hilary Miller

Just asked my pharmacist. Combo: $48. Two pills: $12. I switched. Saved $432/year. Done.

Margaret Khaemba

This is so helpful! I had no idea single-source generics could be so expensive. I just assumed ‘generic’ meant cheap. I checked my plan and my combo was $55 vs $14 for the two. I’m asking my doctor to split it tomorrow. Thank you for breaking this down so clearly!

Malik Ronquillo

Why do people even bother with insurance anymore? Just pay cash for the two pills and call it a day. The system is rigged and nobody wants to admit it. I’ve been doing this for years. My doctor doesn’t even ask anymore. Just hands me two scripts. Simple. Efficient. No bureaucracy.

Alec Amiri

Oh wow so the combo is expensive because it’s single-source? That’s wild. I thought generics were always cheap. Guess I’m just a sucker for the word ‘generic.’ Guess I’ll be switching to separate pills now. Thanks for the wake-up call. Also, why does Medicare even let this happen? Someone’s getting rich off my blood pressure meds.

Lana Kabulova

Wait-so if the combo is in Tier 2 and the individual pills are in Tier 1, that’s not an error? That’s intentional? Then why doesn’t the government regulate this? And why do doctors assume the combo is better? Did they even read the formulary? This is a systemic failure. And now I’m mad. And also, I’m going to file a complaint with my state’s insurance commissioner. This is unacceptable.

Mike P

Look, if you're on Medicare and you're still letting them screw you over like this, you're not just lazy-you're enabling the whole scam. This isn't rocket science. You look up the drugs. You ask the pharmacist. You tell your doctor to write two scripts. Done. I did it last year. Saved $600. You're not special. You're not broke. You're just not trying. America is built on hustle. Stop being a victim and start being a shopper.

Keith Helm

It is imperative that patients exercise due diligence in verifying formulary tier assignments prior to pharmaceutical dispensation. Failure to do so constitutes a lapse in fiduciary responsibility toward one’s own health economics.

Daphne Mallari - Tolentino

The structural inefficiencies inherent in the current pharmaceutical reimbursement model are not merely fiscal anomalies-they are epistemological failures of the managed care paradigm. One must interrogate the ontological status of the ‘generic’ label when it is divorced from competitive market dynamics. The single-source generic, in this context, is not a generic at all, but a pseudo-brand, a regulatory fiction perpetuated by PBM oligopolies.

Chiraghuddin Qureshi

Bro, I did this in Delhi last month. Same thing. Combo: ₹4,200. Two pills: ₹1,100. Doctor was shocked I knew to ask. Now all my friends do it too. 🇮🇳💊✌️